Concerning Cash - A History.

- Emma

- Nov 25, 2020

- 3 min read

They say money doesn't buy happiness, but there's nothing quite like a child's face when they wake up to discover the tooth fairy has visited and left them a shiny coin (or two)...

These days, we take the making and collection of payments for granted, we can make payments electronically in seconds without any money physically changing hands which has made financial transactions possible at almost any time and virtually any place.

But where did It start?

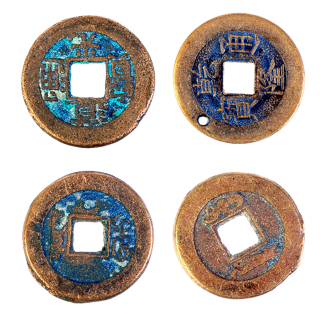

If we take a step back in time, Coins were introduced as a method of payment from the 5 century BCE, they were made of electrum, an alloy of silver and gold. The invention of coins however, is still shrouded in mystery. In fact the word cash was originally

used to describe the type of round bronze coins with square holes. Transporting large sums of heavy bulk copper coins over long distances for traders to complete large commercial transactions could agreeably be impractical at times and In 118 BC promissory notes made of leather appeared in China - A promissory note is a financial instrument that contains a written promise by one party (the note's issuer or maker) to pay another party (the note's payee) a definite sum of money, either on demand or at a specified future date. These notes can be seen as a predecessor to regular banknotes.

The first known banknote was first developed in China in the 7th century and was used as currency for a long time before it found its way to other countries. When the famous traveller Marco Polo visited China, somewhere between 1275 and 1292, he found paper money so intriguing that he dedicated a whole chapter to it in his book. The Travels of Marco Polo", titled "How the Great Kaan Causeth the Bark of Trees, Made into Something Like Paper, to Pass for Money All Over his Country."

This money was used in China for more than 500 years before the practice began to catch on in Europe in the 13th century.

In 1694 the Bank of England was established to raise money for King William III's war against France. The Bank started to issue notes in return for deposits They were initially handwritten on handwritten Bank paper and signed by one of its cashiers and like a promise note they had a similar phrase "I promise to pay the bearer on demand the sum of ...." which still appears on British banknotes today.

On 17 March 1960, the first banknote featuring Queen Elizabeth II was initiated, Up until this point, Britannia had been the only character to appear on our banknotes. In 1946, a Brooklyn banker called John Biggins invented the Charg-It card, which was the first ever credit card, The direct debit system of payment collection followed in 1964 inspired by Unilever’s need to collect payments from ice cream vendors.

In the UK, Barclays bank issued the first credit card in 1966 and the debit card in 1987. As paying digitally continues to become widely accepted, there are still so many people that paying with cash is the only option and many people say that they like cash because It is a fast and convenient way to pay, also very widely accepted and It is helpful for budget management. According to the Bank of England, there are over 70 billion pounds worth of notes in circulation and as of October 2019, there were an estimated 29 billion coins circulating in the UK.

Over the next few weeks we will continue to explore the past and the role it has in our lives and the future. Come back next Wednesday for more articles - Simply signup here to our newsfeed to stay informed.

If you’d like to talk to us about specific security products or ask a question about any of our services, please email sales@csguk.com or call us +44 (0) 844 8000 448.

and we'll be more than happy to help...

Comments